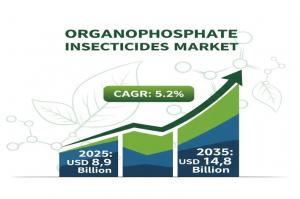

Organophosphate Insecticides Market to Hit USD 14.8 Billion by 2035, Driven by Rising Crop Protection Demand

The Organophosphate Insecticides Market is driven by rising pest control demand in agriculture, ensuring higher crop yields and food security worldwide.

NEWARK, DE, UNITED STATES, August 21, 2025 /EINPresswire.com/ -- The global Organophosphate Insecticides Market is poised for steady expansion, projected to grow from USD 8.9 billion in 2025 to USD 14.8 billion by 2035, at a CAGR of 5.2%. Despite mounting regulatory scrutiny, the sector continues to demonstrate resilience, fueled by the escalating need for effective pest management, rising crop acreage in developing regions, and reliance on cost-efficient agrochemical solutions.

A Balanced Growth Outlook for Manufacturers

Analysis of absolute dollar opportunities reveals a consistent upward trajectory for manufacturers and distributors. Between 2025 and 2030, the market will add USD 2.6 billion, accounting for 44% of the total opportunity, while the 2030–2035 period will generate a further USD 3.3 billion, 56% of the overall growth. This trajectory indicates not only sustained demand but also a back-loaded growth profile, ensuring long-term relevance for producers investing in innovation, distribution, and scale.

The drivers are clear: pest resistance, high-output agricultural systems, and stored grain protection continue to underscore the relevance of organophosphates in diverse geographies. While North America and Europe face tighter regulations, emerging markets in Asia-Pacific, Africa, and Latin America remain significant revenue pools where efficacy, affordability, and availability dictate demand.

Market Contribution Across Crop Protection Ecosystem

Organophosphates represent:

• 22–25% of the total insecticides market.

• 14–16% of the broader crop protection chemicals market.

• 10–12% of the global agrochemicals market.

• 6–8% of the agricultural inputs market.

• 8–10% of the pesticide formulation market.

This footprint demonstrates their strategic role within global food production systems, particularly where integrated pest management practices remain limited and chemical control continues as the frontline defense.

Chlorpyrifos and Agricultural Segments Lead the Market

By active ingredient, Chlorpyrifos will dominate with 35.7% share in 2025, owing to proven efficacy, cost efficiency, and compatibility across multiple crops. Its strong adoption in integrated pest management reinforces its position as a cornerstone solution, despite ongoing regulatory discussions.

By application, the Agricultural segment will command 72.3% of the market by 2025, highlighting the essential role of organophosphates in safeguarding cereal, fruit, and vegetable crops. Farmers continue to rely on their fast knockdown and residual activity, especially in emerging economies where mechanization and modern practices are still evolving.

Regional and Country-Level Dynamics

Growth is not uniform, presenting manufacturers with diverse strategic opportunities:

• China (7.0% CAGR): Reliance on organophosphates in rice and vegetables, supported by strong domestic production.

• India (6.5% CAGR): Robust demand in cotton and paddy cultivation; strengthened by local distribution networks.

• Germany (6.0% CAGR): Targeted usage under exemptions, with demand in controlled horticultural environments.

• UK (4.9% CAGR): Adoption of dual-action regimes amid regulatory compliance.

• USA (4.4% CAGR): Specialized demand in corn, soybeans, and sugarcane despite phase-out plans.

These variations underscore the need for regionally adaptive product portfolios—balancing affordability, compliance, and innovation.

Case Studies Driving Adoption

• Brazil & Argentina: Organophosphate usage surged 26% in 2025 as resistant pests threatened soybean and cotton crops. Yield losses dropped by 18% with chlorpyrifos and malathion adoption.

• India: Public health vector control programs boosted malathion demand by 32%, reducing mosquito vector densities by up to 25%.

• Vietnam, Kenya, Paraguay: Dual-mode formulations combining organophosphates with pyrethroids cut application frequency by 18%.

• Southeast Asia: Generic production expansion lowered treatment costs by 22%, improving accessibility for smallholder farmers.

These examples illustrate how affordability, field efficacy, and institutional support are sustaining long-term usage across both agriculture and public health sectors.

Competitive Landscape: Innovation Meets Scale

Leading players such as Syngenta Crop Protection AG, BASF SE, Bayer AG, ADAMA, Sumitomo Chemicals, UPL, and Nufarm Limited are shaping the future of the market through a mix of innovation and scale. While multinational firms are reformulating older chemistries into safer, targeted solutions, regional manufacturers in Asia-Pacific are driving accessibility through cost-competitive generic production.

Companies such as Compass Minerals, Israel Chemical Company, K+S Group, and Yara International are integrating organophosphates within broader crop nutrition and protection portfolios, addressing farmer needs for comprehensive yield resilience solutions.

Notable developments include:

• BASF’s submission of Prexio® Active (Feb 2025): Targeting rice hopper species in Asia-Pacific, with launches scheduled in India, China, Vietnam, and Indonesia.

• Nepal’s nationwide ban (Dec 2024): On chlorpyrifos, phorate, and paraquat, signaling tightening regulations but also opportunities for next-generation substitutes.

Request Organophosphate Insecticides Market Draft Report:

https://www.futuremarketinsights.com/reports/sample/rep-gb-23028

For more on their methodology and market coverage, visit https://www.futuremarketinsights.com/about-us.

Growth Drivers and Market Challenges

The growth of the Organophosphate Insecticides Market is propelled by:

• Rising pest resistance to pyrethroids and need for rotational solutions.

• Expanding food security initiatives and arable land in emerging regions.

• Cost-effective pest control essential to yield-sensitive economies.

However, manufacturers must navigate:

• Regulatory scrutiny in Europe and North America.

• Rising demand for biodegradable, safer formulations.

• Growing farmer awareness of integrated pest management.

Related Insights from Future Market Insights (FMI)

Organophosphate Pesticides Market - https://www.futuremarketinsights.com/reports/organophosphate-pesticides-market

Bioinsecticides Market - https://www.futuremarketinsights.com/reports/bioinsecticides-market

Carbamate Insecticides Market - https://www.futuremarketinsights.com/reports/carbamate-insecticides-market

Editor’s Note:

The Organophosphate Insecticides Market is undergoing steady demand, driven by expanding agricultural practices and rising pest control needs. However, regulatory restrictions and environmental concerns are reshaping its growth outlook. This report provides a detailed analysis of trends, challenges, and opportunities shaping the market’s future.

Rahul Singh

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.